Fiscal year is February-January. Earnings Before Interest Taxes and Depreciation Amortization EBITDA is likely to gain to about 368 B in 2021 whereas Earnings before Tax are likely to drop slightly above 182 B in 2021. Property and equipment including finance lease right-of-use assets net Amount after accumulated depreciation depletion and amortization of physical assets used in the normal conduct of business to produce goods and services and not intended for resale. The balance sheet is a financial report that shows the assets of a business ie. After each line item is defined and discussed I finally offer a summary analysis of Walmarts important income statement line item trends from 2017 to 2021 in most cases. How to analyze an income statement. Debt 1978 Capital lease and financing obligations 352 Interest. Net Income 1351B 1488B. Wal-Mart Stores Income Statement is one of the three primary financial statements used for reporting Wal-Marts overall financial performance over a current year or for a given accounting period. Find out the revenue expenses and profit or loss over the last fiscal year.

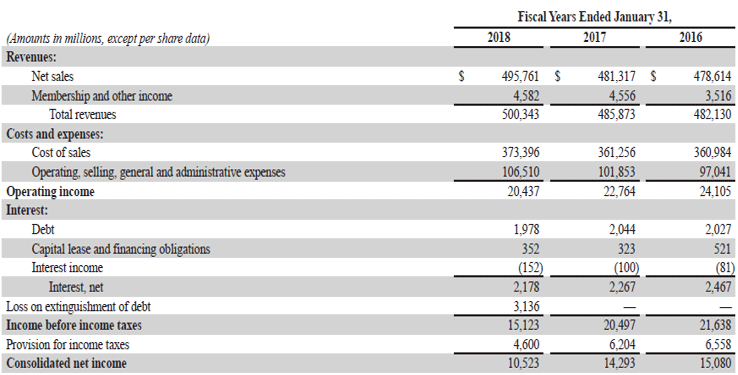

After each line item is defined and discussed I finally offer a summary analysis of Walmarts important income statement line item trends from 2017 to 2021 in most cases. The balance sheet is a financial report that shows the assets of a business ie. Debt 1978 Capital lease and financing obligations 352 Interest. From this I then discuss and define income statement line items such as revenues gross profits etc. Find out the revenue expenses and profit or loss over the last fiscal year. Net Income 1351B 1488B. Property and equipment including finance lease right-of-use assets net Amount after accumulated depreciation depletion and amortization of physical assets used in the normal conduct of business to produce goods and services and not intended for resale. Annual stock financials by MarketWatch. 31 rows Revenue. Income Statement Fiscal Year ended January 31 2018 Fiscal All values in USD millions 2018 Revenues.

Data is currently not available. View the latest WMT financial statements income statements and financial ratios. Property and equipment including finance lease right-of-use assets net Amount after accumulated depreciation depletion and amortization of physical assets used in the normal conduct of business to produce goods and services and not intended for resale. DATA AS OF Jul 15 2021 1245 PM ET. Find out the revenue expenses and profit or loss over the last fiscal year. Earnings Before Interest Taxes and Depreciation Amortization EBITDA is likely to gain to about 368 B in 2021 whereas Earnings before Tax are likely to drop slightly above 182 B in 2021. All values USD Millions. Net Income before Extraordinaries-----. 500343 Costs and Expenses. Debt 1978 Capital lease and financing obligations 352 Interest.

Debt 1978 Capital lease and financing obligations 352 Interest. The income statement presents information on the financial results of a companys business activities over a period of time. Get the detailed quarterlyannual income statement for Walmart Inc. Find out the revenue expenses and profit or loss over the last fiscal year. Earnings Before Interest Taxes and Depreciation Amortization EBITDA is likely to gain to about 368 B in 2021 whereas Earnings before Tax are likely to drop slightly above 182 B in 2021. What it owns the liabilities ie. Ten years of annual and quarterly balance sheets for Walmart WMT. Income Statement Fiscal Year ended January 31 2018 Fiscal All values in USD millions 2018 Revenues. 500343 Costs and Expenses. The difference between assets and liabilities.

Common Stock WMT Nasdaq Listed. Wal-Mart Stores reported Net Income Per Employee of 5858 in 2020. 2021 2020 2019 2018 2017 5-year trend. The income statement communicates how much revenue the company generated during a period and what cost it incurred in connection with generating that revenue. Property and equipment including finance lease right-of-use assets net Amount after accumulated depreciation depletion and amortization of physical assets used in the normal conduct of business to produce goods and services and not intended for resale. Fiscal year is February-January. Find out the revenue expenses and profit or loss over the last fiscal year. After each line item is defined and discussed I finally offer a summary analysis of Walmarts important income statement line item trends from 2017 to 2021 in most cases. All values USD Millions. What it owes to others and equity ie.