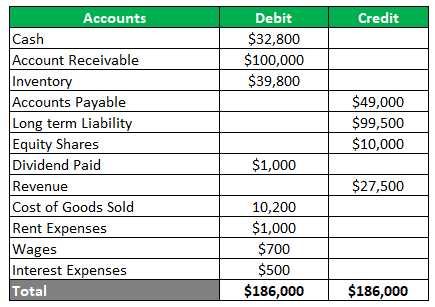

The trial balance lists every open general ledger account by account number and provides separate debit and credit columns for entering account balances. The trial balance is an accounting report or worksheet mostly for internal use listing each of the accounts from the general ledger together with their closing balances debit or credit. This is the most important purpose for which the trial balance is. Bookkeepers and accountants use this report to consolidate all of the T-accounts into one document and double check that all transactions were recorded in proper journal entry format. A trial balance is a bookkeeping or accounting report that lists the balances in each of an organizations general ledger accounts. The trial balance is used to verify the actual amount entered on the right side of the current account while migrating the figures from various ledger books like purchase books sales books cash books etc. A trial balance is an listbalancechart ___ of accounts and their balances at a point in time and is used to confirm that the sum of debit account balances equals the sum of ___ account balances. Use one word for each blank. Recheck the Unbalanced Trial Balance Column Totals. O It is an external document used to verify that the entries listed in the income statement have been properly tabulated.

The purpose of a trial balance is to prove that the value of all the debit value balances equals the total of all the credit value balances. It is an internal document that lists the balances across all. The trial balance sums up all the debit balances in one column and all the credit balances in another column. This is the most important purpose for which the trial balance is. A trial balance lists the ending balance in each general ledger account. A trial balance Is used to verify that the total of debit balances is equal to the total of credit balances. Lists all the companys general ledger accounts and their balances. Often the accounts with zero balances will not be listed The debit balance amounts are listed in a column with the heading Debit balances and the credit balance amounts are listed in another column with the heading Credit balances. A trial balance is used by accountants to confirm the accuracy of the accounts at the end of the financial year before and after special adjustments. A trial balance is a bookkeeping or accounting report that lists the balances in each of an organizations general ledger accounts.

Often the accounts with zero balances will not be listed The debit balance amounts are listed in a column with the heading Debit balances and the credit balance amounts are listed in another column with the heading Credit balances. O It is a document provided to investors to indicate that accounts have been properly calculated. If the total of the debit column does not equal the total value of the credit column then this would show that there is an error in the nominal ledger accounts. A trial balance Is used to verify that the total of debit balances is equal to the total of credit balances. The trial balance is an accounting report or worksheet mostly for internal use listing each of the accounts from the general ledger together with their closing balances debit or credit. A trial balance is a tool used by businesses to double-check their bookkeeping systems to avoid running short or making crucial accounting errors. The trial balance is a report run at the end of an accounting period listing the ending balance in each general ledger account. Question 5 of 22 How is a Trial Balance used. Lists all the companys general ledger accounts and their balances. What is a Trial Balance Used For.

It is an internal document that lists the balances across all. A trial balance is simply a listing of the debit and credit balances for each account in the accounting ledgers. The total dollar amount of the debits and credits in each accounting entry are supposed to match. A trial balance is a bookkeeping or accounting report that lists the balances in each of an organizations general ledger accounts. A trial balance is used by accountants to confirm the accuracy of the accounts at the end of the financial year before and after special adjustments. Bookkeepers and accountants use this report to consolidate all of the T-accounts into one document and double check that all transactions were recorded in proper journal entry format. Therefore if the debit total and credit total on a trial balance do not match this indicates that one or more. After posting all transactions from an accounting period accountants prepare a trial balance to verify that the total of all accounts with debit balances equals the total of all accounts with credit balances. The purpose of a trial balance is to prove that the value of all the debit value balances equals the total of all the credit value balances. The trial balance sums up all the debit balances in one column and all the credit balances in another column.

The purpose of a trial balance is to prove that the value of all the debit value balances equals the total of all the credit value balances. What is a Trial Balance. A trial balance is a bookkeeping worksheet in which the balance of all ledgers are compiled into debit and credit account column totals that are equal. Though not a conclusive proof the agreement of the trial balance is a prima facie evidence of the absence of mathematical errors. The trial balance is used to verify the actual amount entered on the right side of the current account while migrating the figures from various ledger books like purchase books sales books cash books etc. Question 5 of 22 How is a Trial Balance used. A trial balance is an listbalancechart ___ of accounts and their balances at a point in time and is used to confirm that the sum of debit account balances equals the sum of ___ account balances. It is an internal document that lists the balances across all. The total dollar amount of the debits and credits in each accounting entry are supposed to match. The purpose of a trial balance is to ensure that all entries made into an organizations general ledger are properly balanced.