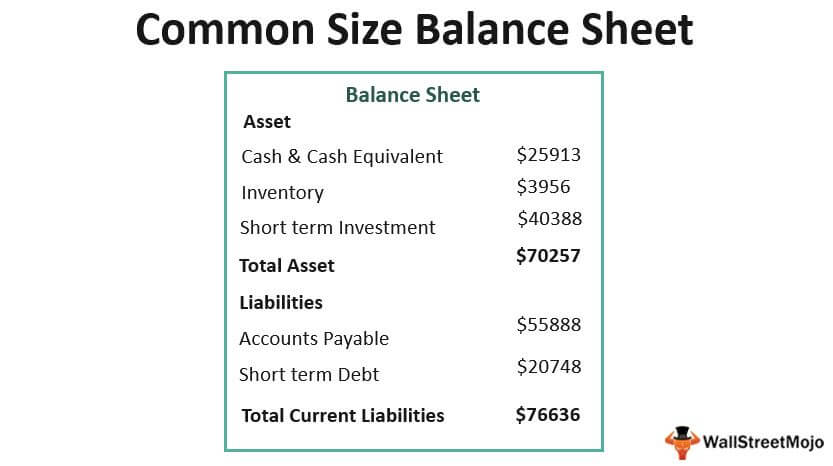

Common size financial statements reduce all figures to a comparable figure such as a. Common size financial statement is a method to represent financial data in a percentage format. To calculate it gather your financial statements and use the following process. Each item is then expressed as a percentage of sales. Analysis of Components of Financial Statements. For example if total sales revenue is used as the common base figure then other. Common size financial statements commonly include the income statement balance sheet and cash flow statement. One tool of financial analysis is common-size financial statements. Discounted Cash Flow DCF Valuation. A common size financial statement displays items on a financial statement as a percentage of a common base figure.

Discounted Cash Flow DCF Valuation. Analysis of Components of Financial Statements. For example lets assume that Company XYZs income statement looks like this. Analysis of Financial Ratios. To common size an income statement analysts divide each line item eg. The financial statement reports owner equity assets. Analysis of Financial Ratios. Common-Size Financial Statements Analysts also use vertical analysis of a single financial statement such as an income statement. Note that the accounting statement of cash flows is not converted into a common- size statement. It is being done in order to make it easier to analyze a company in dynamics and compare it with other firms making the.

For example gross margin is calculated by dividing gross profit by sales. A common size financial statement displays items on a financial statement as a percentage of a common base figure. Note that the accounting statement of cash flows is not converted into a common- size statement. Add all the line items on the financial statement youre analyzing Choose a single line item from the statement. The financial statement reports owner equity assets. Economic Value Added EVA Long-term Trends. Sometimes items on companys financial statement are being displayed as a percentage of a common figure. Types of Common Size Analysis Common size analysis can be conducted in two ways ie vertical analysis and horizontal analysis. For example if total sales revenue is used as the common base figure then other. Explanation of Common Size Financial Statement.

Common size financial statement analysis is computed using the following formula. Common-Size Financial Statements Analysts also use vertical analysis of a single financial statement such as an income statement. Describe common-size financial statements and explain why they are used. Overview of Common Size Financial Statements The financial statements of an organization primarily consist of the balance sheet cash flow statement and income statement. Common Size Financial Statements expresses every item of financial statement in terms of a percentage of one convenient base parameter. Vertical analysis refers to the analysis of specific line items in relation to a base item within the same financial period. Analysis of Financial Ratios. For example lets assume that Company XYZs income statement looks like this. Common size financial statement is a method to represent financial data in a percentage format. Common size financial statements reduce all figures to a comparable figure such as a.

For example gross margin is calculated by dividing gross profit by sales. Note that the accounting statement of cash flows is not converted into a common- size statement. For example lets assume that Company XYZs income statement looks like this. Analysis of Components of Financial Statements. A common size financial statement displays items on a financial statement as a percentage of a common base figure. Prices of access to the entire website 3 months. One tool of financial analysis is common-size financial statements. Common size financial statements commonly include the income statement balance sheet and cash flow statement. Common Size Financial Statements expresses every item of financial statement in terms of a percentage of one convenient base parameter. A common-size financial statement is an income statement or balance sheet in which each line items are expressed as a percentage of sales or assets respectively.