Accumulated depreciation is shown on the balance sheet just below the related asset. The depreciation expense account is debited each year by expending a portion of the asset for that particular year. The presentation on the balance sheet will look. A deduction from profit on the st atement of owners equity. A contra account on the balance sheet. For example company XYZ has a vehicle of R400 000 cost price and the accumulated depreciation related to the vehicle amounts to R200 000. Is used to show the amount of cost expiration of intangibles. The accumulated depreciation account is also credited from the same amount. An addition to equipment on the balance sheet. Accrued salaries are a.

Accumulated Depreciation Equipment is shown as a. The book value of an asset is calculated by deducting the accumulated depreciation from the original purchase price. An expense on the income statement. The accumulated depreciation account is a contra asset account on a companys balance sheet meaning it has a credit balance. Accumulated depreciation amounts are shown as deductions from the cost of building and equipment accounts accounts receivable account. The accumulated depreciation account is also credited from the same amount. You take the depreciation for all capital assets for the current year and add to the accumulated depreciation on those assets for previous years to get the current years accumulated depreciation on your business balance sheet. An expense on the income statement. The presentation on the balance sheet will look. An addition to equipment on the balance sheet.

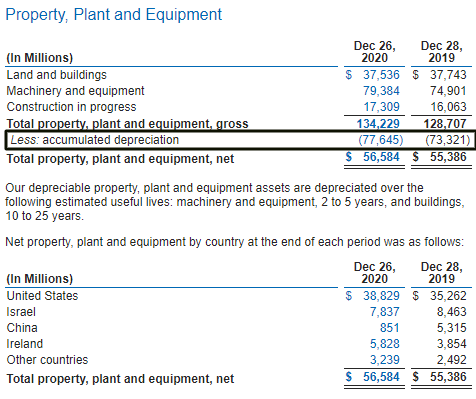

Accumulated depreciation is an accounting term. Accumulated Depreciation Accumulated depreciation is a running total of depreciation expense for an asset that is recorded on the balance sheet. B accounts payable account. Accounts that record accumulated depreciation are shown on the. The accumulated depreciation account is a contra asset account on a companys balance sheet meaning it has a credit balance. An addition to equipment on the balance sheet. Is used to show the amount of cost expiration of natural resources. Accumulated depreciation amounts are shown as deductions from the cost of building and equipment accounts accounts receivable account. Balance sheet as deductions from assets. The depreciation expense account is debited each year by expending a portion of the asset for that particular year.

Balance sheet as deductions from assets. Accumulated depreciation also increases over the years as depreciated expenses are charged against the value of fixed assets. The book value of an asset is calculated by deducting the accumulated depreciation from the original purchase price. The presentation on the balance sheet will look. Over time the depreciation of an asset will build up - the total depreciation over a period of time is known as accumulated depreciation. An expense on the income statement. Question 2 At 30 June 2019 the financial statements of McMaster Ltd showed a building with a cost net of GST of 240000 and accumulated depreciation of 122000. B accounts payable account. For example company XYZ has a vehicle of R400 000 cost price and the accumulated depreciation related to the vehicle amounts to R200 000. Is a contra asset account.

An addition to equipment on the balance sheet. A deduction from profit on the st atement of owners equity. Accumulated depreciation amounts are shown as deductions from the cost of building and equipment accounts accounts receivable account. The presentation on the balance sheet will look. The basic journal entry for depreciation is to debit the Depreciation Expense account which appears in the income statement and credit the Accumulated Depreciation account which appears in the balance sheet as a contra account that reduces the amount of fixed assets. You take the depreciation for all capital assets for the current year and add to the accumulated depreciation on those assets for previous years to get the current years accumulated depreciation on your business balance sheet. Accounts that record accumulated depreciation are shown on the. A contra account on the balance sheet. Question 2 At 30 June 2019 the financial statements of McMaster Ltd showed a building with a cost net of GST of 240000 and accumulated depreciation of 122000. A liability on the balance sheet.