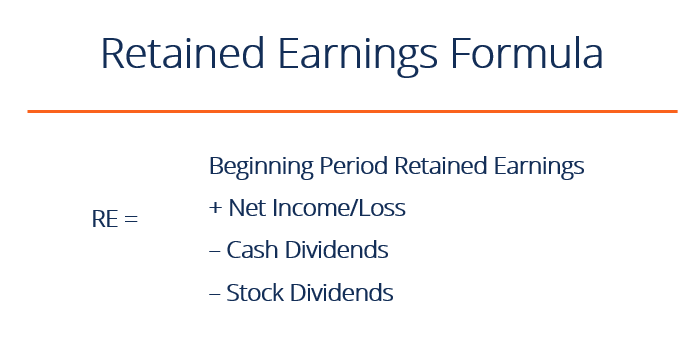

Beginning of Period Retained Earnings At the end of each accounting period retained earnings are reported on the balance sheet as the accumulated income from the prior year including the current years income minus dividends paid to shareholders. Retained earnings are calculated by subtracting dividends from the sum total of retained earnings balance at the beginning of an accounting period and the net profit or - net loss of the accounting period. Example of the Retained Earnings Formula ABC International has 500000 of net profits in its current year pays out 150000 for dividends and has a beginning retained earnings balance of 1200000. The formula for calculating retained earnings is as follows. Suppose a firms beginning retained earnings is 150000 with net income 30000 and dividend of 3000 the retained earnings will be Retained Earnings 150000 30000 - 3000 17700000. Retained earnings are the net income from a companys historical profits retained after paying out dividends to its shareholders. Take your total sales for the period and subtract your expenses operating costs depreciation of your fixed assets and taxes. If youre the sole owner that means any profits left. How to calculate retained earnings The retained earnings balance is the sum of total company earnings net income since inception less all cash dividends paid since the firms inception. The amount for retained earnings is part of the net income.

The retained earnings formula is. Take your total sales for the period and subtract your expenses operating costs depreciation of your fixed assets and taxes. In a period of profit the formula is. Suppose a firms beginning retained earnings is 150000 with net income 30000 and dividend of 3000 the retained earnings will be Retained Earnings 150000 30000 - 3000 17700000. 1200000 Beginning retained earnings. These are the retained earnings that have carried over from the previous accounting period. Calculating Retained Earnings 1. Retained earnings are the net income from a companys historical profits retained after paying out dividends to its shareholders. Theres a bit of financial jargon in. These earnings are the amounts used to distribute to shareholders or reinvests based on the entitys dividend and investment policies.

Retained earnings Beginning retained earnings Net income or loss - Dividends For example a company may begin an accounting period with 7000 of retained earnings. Suppose a firms beginning retained earnings is 150000 with net income 30000 and dividend of 3000 the retained earnings will be Retained Earnings 150000 30000 - 3000 17700000. Retained earnings are all the net income profits you have left after paying out dividends or distributions to ownersshareholders. Current Retained Earnings ProfitLoss Dividends Retained Earnings Your accounting software will handle this calculation for you when it generates your companys balance sheet statement of. If you need to do a retained earnings calculation theres a pretty simple formula that you can use. The formula for calculating Retained Earning The formula for calculating retained earnings in a situation where the company has a positive result is not the same as when there is a loss. Its retained earnings calculation is. Take your total sales for the period and subtract your expenses operating costs depreciation of your fixed assets and taxes. Beginning of Period Retained Earnings At the end of each accounting period retained earnings are reported on the balance sheet as the accumulated income from the prior year including the current years income minus dividends paid to shareholders. These earnings are the amounts used to distribute to shareholders or reinvests based on the entitys dividend and investment policies.

Retained earnings Beginning retained earnings Net income or loss - Dividends For example a company may begin an accounting period with 7000 of retained earnings. Retained earnings are the accumulation of the entitys net profit from the beginning to the reporting date after deducting the dividend payments to shareholders. RE RE 0 NI D. Calculate your net income during the reporting period. Retained earnings are calculated to-date meaning they accrue from one period to the next. So to begin calculating your current retained earnings you need to know what they were at the beginning of the time period youre calculating usually the previous quarter or year. The formula for calculating retained earnings is as follows. Retained earnings are calculated by subtracting dividends from the sum total of retained earnings balance at the beginning of an accounting period and the net profit or - net loss of the accounting period. If youre the sole owner that means any profits left. If you need to do a retained earnings calculation theres a pretty simple formula that you can use.

The amount for retained earnings is part of the net income. Retained earnings RE beginning retained earnings net income or net loss cash dividends stock dividends. Retained earnings are the net income from a companys historical profits retained after paying out dividends to its shareholders. Retained earnings are calculated to-date meaning they accrue from one period to the next. Businesses can choose to accumulate earnings for use in the business or pay a portion of earnings as a dividend. Take your total sales for the period and subtract your expenses operating costs depreciation of your fixed assets and taxes. Your beginning retained earnings balance. Beginning of Period Retained Earnings At the end of each accounting period retained earnings are reported on the balance sheet as the accumulated income from the prior year including the current years income minus dividends paid to shareholders. To calculate it one needs to subtract the cost of doing business from the revenue. Retained earnings are the accumulation of the entitys net profit from the beginning to the reporting date after deducting the dividend payments to shareholders.