Name of the Company. The auditors report should also state whether the company has adequate IFC system in place and the operating effectiveness of such controls Sec 177 Audit committee may call for comments of auditors about internal control systems before their submission to the Board and may also discuss any related issues with the internal and statutory auditors and the management of the company. Accordingly the auditor should report if the company has adequate internal control systems in place and whether they were operating effectively at the balance sheet date. Sales reconciled with inventory change. Control over sales to employees. In accordance with the reporting criteria applicable during the year ended June 30 2020 the Reporting Criteria consisting of IFCs instructions procedures and guidelines specific to each Indicator a summary of which is provided in the Annual Report or on IFCs website. IFC reporting on interim financial statements It may also be noted that an auditors reporting on IFC is a. Auditors report Audit Committee presentation Discussion with Management Drawing conclusion Aggregation of findings Fieldwork Planning scoping Overview applicability components of IFC Risk assessment Sources of misstatement Selecting controls to test ELCs understanding IT automated controls Financial reporting process. The financial statements have been audited by an independent accounting firm which was given unrestricted access to all financial records and related data including minutes of all meetings of the Board of Executive Directors and committees of the Board. Audit of Internal Financial controls hereinafter to be referred as IFC over Financial Reporting is a reasonably advanced reporting concept for India.

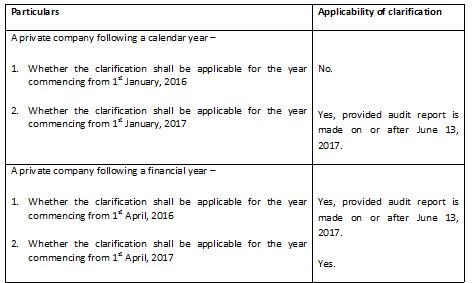

Section 1433i Auditor has to state whether the company has adequate IFC system in place and the operating effectiveness of such controls. In accordance with the reporting criteria applicable during the year ended June 30 2020 the Reporting Criteria consisting of IFCs instructions procedures and guidelines specific to each Indicator a summary of which is provided in the Annual Report or on IFCs website. Sales reconciled with cash receipts and AR. Y This section deals with powers and duties of Auditors while providing an opinion on. Statutory auditors are required to report on the adequacy and operating effectiveness of a companys IFCFR. Auditors report Audit Committee presentation Discussion with Management Drawing conclusion Aggregation of findings Fieldwork Planning scoping Overview applicability components of IFC Risk assessment Sources of misstatement Selecting controls to test ELCs understanding IT automated controls Financial reporting process. Audit of Internal Financial controls hereinafter to be referred as IFC over Financial Reporting is a reasonably advanced reporting concept for India. IFC Reporting applicability for the financial year ended 31 March 2017 under various scenario March 2016 being latest audited financial statements available. Sec 143 deals with Powers and Duties of Auditors and Auditing Standards while carrying out Audit of FS. Accordingly the auditor should report if the company has adequate internal control systems in place and whether they were operating effectively at the balance sheet date.

Audit of Internal Financial controls hereinafter to be referred as IFC over Financial Reporting is a reasonably advanced reporting concept for India. The presentation of the Statements in accordance. Matching of credit memoranda and receiving reports. Control over sales to employees. With two years of experience in the implementation of IFC and one year in. IFC reporting on interim financial statements It may also be noted that an auditors reporting on IFC is a. Y This section deals with powers and duties of Auditors while providing an opinion on. Consequently the auditors of such companies are not required to specify about IFC of the company in its audit report in respect of financial statements pertaining to FY commencing on or after April 01 2016 provided such financial statement is prepared after June 13 2017. Auditors report Audit Committee presentation Discussion with Management Drawing conclusion Aggregation of findings Fieldwork Planning scoping Overview applicability components of IFC Risk assessment Sources of misstatement Selecting controls to test ELCs understanding IT automated controls Financial reporting process. Control over scrap sales.

The financial statements have been audited by an independent accounting firm which was given unrestricted access to all financial records and related data including minutes of all meetings of the Board of Executive Directors and committees of the Board. As its name suggest Internal Financial Control it is refer to control implemented in Financial. Section 1433i Auditor has to state whether the company has adequate IFC system in place and the operating effectiveness of such controls. Audit of Internal Financial controls hereinafter to be referred as IFC over Financial Reporting is a reasonably advanced reporting concept for India. The presentation of the Statements in accordance. In accordance with the reporting criteria applicable during the year ended June 30 2020 the Reporting Criteria consisting of IFCs instructions procedures and guidelines specific to each Indicator a summary of which is provided in the Annual Report or on IFCs website. Statutory auditors are required to report on the adequacy and operating effectiveness of a companys IFCFR. Y This section deals with powers and duties of Auditors while providing an opinion on. The auditors report should also state whether the company has adequate IFC system in place and the operating effectiveness of such controls Sec 177 Audit committee may call for comments of auditors about internal control systems before their submission to the Board and may also discuss any related issues with the internal and statutory auditors and the management of the company. Consequently the auditors of such companies are not required to specify about IFC of the company in its audit report in respect of financial statements pertaining to FY commencing on or after April 01 2016 provided such financial statement is prepared after June 13 2017.

IFC reporting on interim financial statements It may also be noted that an auditors reporting on IFC is a. As its name suggest Internal Financial Control it is refer to control implemented in Financial. IFC Annual Report 2018. Name of the Company. AR statement to all customers. Section 1433i Auditor has to state whether the company has adequate IFC system in place and the operating effectiveness of such controls. Our audit of internalfinancial controls over financial reporting included obtaining an understanding ofinternal financial controls over financial reporting with reference to these standalonefinancial statements assessing the risk that a material weakness exists and testing andevaluating the design and operating effectiveness of internal control based on theassessed risk. The reporting by the auditors was voluntary for the year ending 31 March 2015 and mandatory for financial years beginning on or after 1 April 2015. Matching of credit memoranda and receiving reports. Audit of Internal Financial controls hereinafter to be referred as IFC over Financial Reporting is a reasonably advanced reporting concept for India.