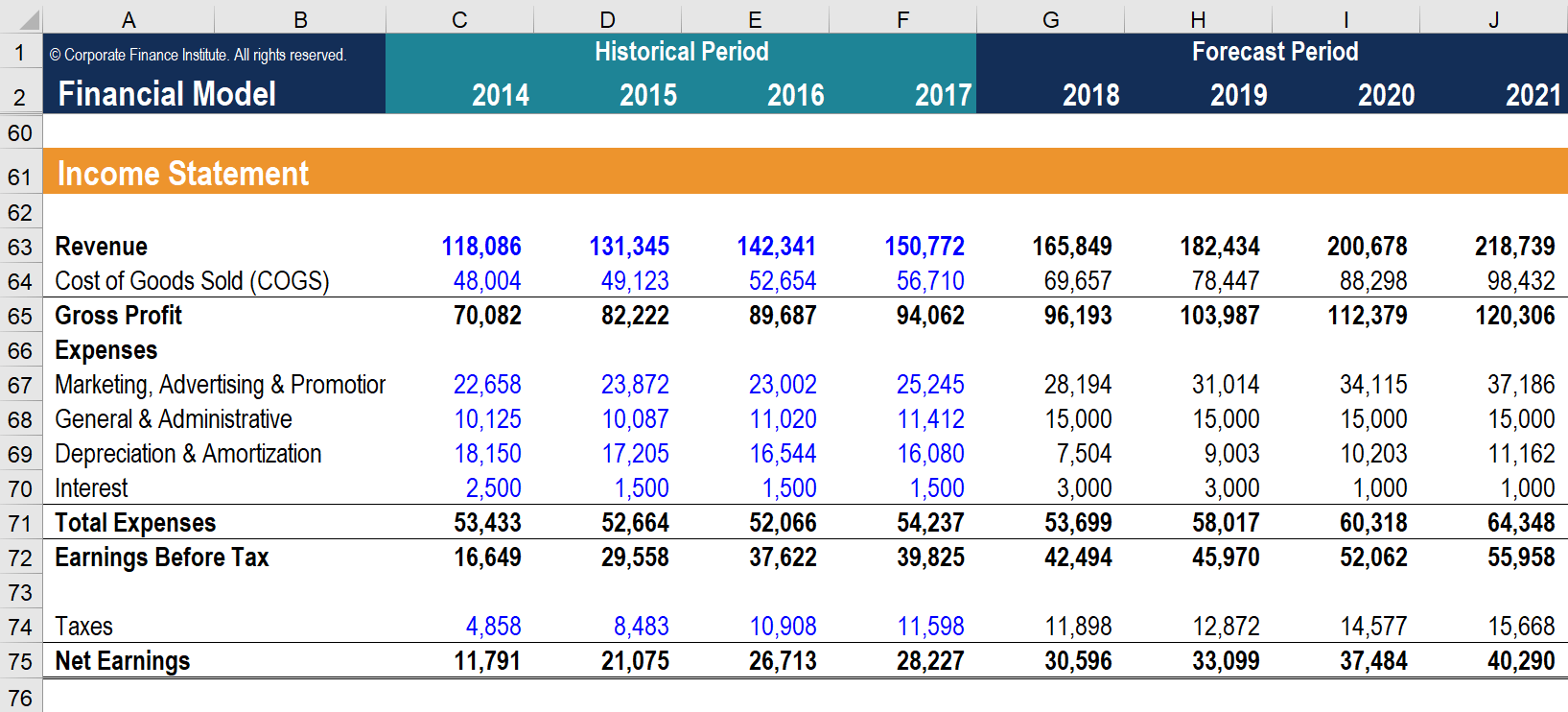

Income statements are used to report the operating costs and profits of a business while assisting team leaders with making important business decisions. The third section calculates gains and losses unrelated to your operational costs. The income statement is one of the five financial statements that report and present an entitys financial transactions or performance including revenues expenses net profit or loss and other PL Items for a specific period of time. This contrasts with a balance sheet which shows account balances for one exact date. The first section of the income statement calculates gross profit or the total amount of money made from sales revenue and cost of goods sold. Taxes on an income statement are at the bottom below the pretax income. An income statement is a financial statement that shows you how profitable your business was over a given reporting period. The income statement shows the businesss income expenses gains and losses. The following are some common accounting items that can be included on income statements. If you want to use an Income Statement the best way is to do it is monthly and at the end of the year combine all your monthly statements to produce your Annual Income Statement.

If you want to use an Income Statement the best way is to do it is monthly and at the end of the year combine all your monthly statements to produce your Annual Income Statement. The income statement presents the financial results of a business for a stated period of time. Taxes on an income statement are at the bottom below the pretax income. 3 Elements of Income Statement. It shows performance -- the companys revenues minus expenses equal. The third section calculates gains and losses unrelated to your operational costs. The end product of these transactions is net income or loss. However there are several generic line items that are commonly seen in any income statement. It shows your revenue minus your expenses and losses. The income statement shows the businesss income expenses gains and losses.

The income statement summarizes all revenues and expenses in the business transactions during the accounting period by following the general form of Revenues minus Expenses equals Net Income which are the three main elements of the income statement. Taxes on an income statement are at the bottom below the pretax income. The income statement is one of the five financial statements that report and present an entitys financial transactions or performance including revenues expenses net profit or loss and other PL Items for a specific period of time. It shows performance -- the companys revenues minus expenses equal. Also sometimes called a net income statement or a statement of earnings the income statement is one of the three most important financial statements in financial. 1 An income statement always represents a period of time like a month quarter or a year. Income statements are used to report the operating costs and profits of a business while assisting team leaders with making important business decisions. The income statement presents the financial results of a business for a stated period of time. The three main elements of income statement include revenues expenses and net income. The first section of the income statement calculates gross profit or the total amount of money made from sales revenue and cost of goods sold.

The third section calculates gains and losses unrelated to your operational costs. The income statement is one of the five financial statements that report and present an entitys financial transactions or performance including revenues expenses net profit or loss and other PL Items for a specific period of time. The income statement presents the financial results of a business for a stated period of time. The statement quantifies the amount of revenue generated and expenses incurred by an organization during a reporting period as well as any resulting net profit or loss. It shows your revenue minus your expenses and losses. The income statement comes in two forms multi-step and single-step. This is the first section that appears on the income statement. While the balance sheet constitutes a financial snapshot at a given point in time such as December 31 the income statement summarizes a financial movie of operational results over a period of time such as for the year ending December 31. The income statement includes elements like revenue expenses gross profit and losses. An income statement is a financial statement that shows you how profitable your business was over a given reporting period.

3 Elements of Income Statement. The most common income statement items include. The income statement includes elements like revenue expenses gross profit and losses. The end product of these transactions is net income or loss. An income statement is a record that measures and shows all the expenses and revenues a company incurred during a specific period of time. If you want to use an Income Statement the best way is to do it is monthly and at the end of the year combine all your monthly statements to produce your Annual Income Statement. Taxes on an income statement are at the bottom below the pretax income. Your revenue earned through selling your products or services. 1 An income statement always represents a period of time like a month quarter or a year. It shows performance -- the companys revenues minus expenses equal.