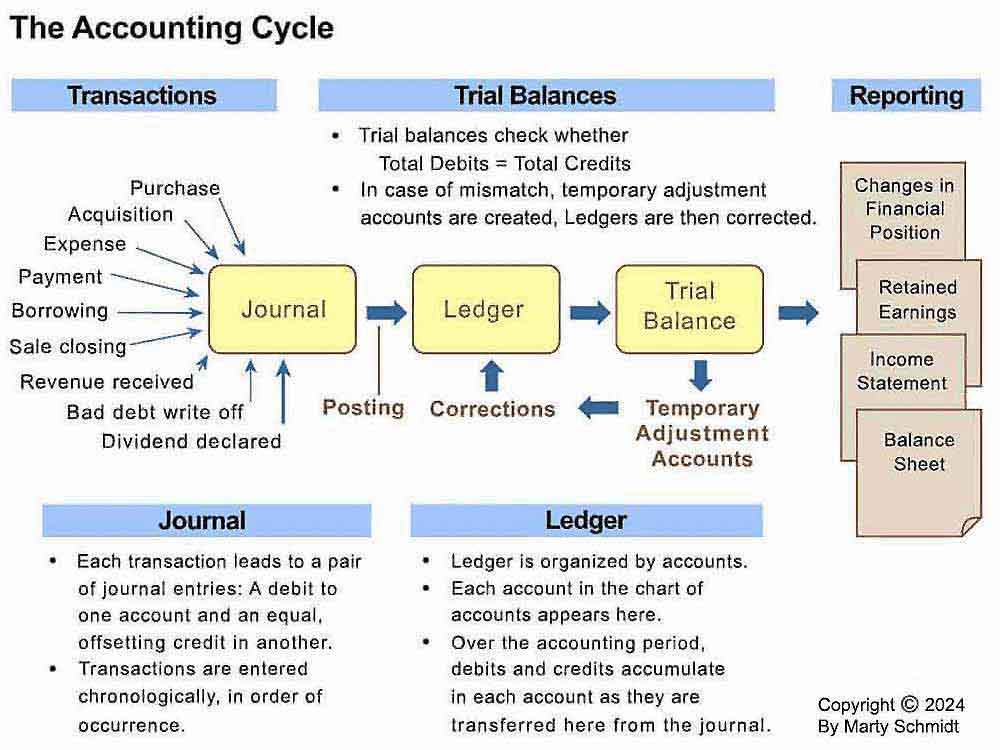

There are three types of trial balances. All of the income and expense accounts are typically closed to a general income summary account which is later closed to the retained earnings or capital account. After posting all financial transactions to the accounting journals and summarizing them in the general ledger a trial balance is prepared to verify that the debits equal the credits on the chart of accountsThe trial balance is the next step in the accounting cycleIt is the first step in the end of the accounting period process. Business Liquidity and the Operating Cycle 221 Working Capital. Classi ed Balance Sheets Þ 211 Assets 212 Liabilities 213 Equity 214 Other Entity Forms 215 Notes to the Financial Statements 22. In what order should they be prepared. The accounting cycle requires three trial balances be done. The accounting cycle requires three trial balances be done. Trial Balance is prepared basically to check if debit or credit amounts recorded in the ledger accounts are accurate. An unadjusted trial balance is prepared.

What effect does this have on the accounting equation. What does a trial balance include. After the adjusted trial balance is created the temporary accounts are closed to the permanent accounts with a series of closing journal entries. Business Liquidity and the Operating Cycle 221 Working Capital. After posting all financial transactions to the accounting journals and summarizing them in the general ledger a trial balance is prepared to verify that the debits equal the credits on the chart of accountsThe trial balance is the next step in the accounting cycleIt is the first step in the end of the accounting period process. The process of preparing complete financial statements starts with the culling of accounts and balances from the preparation of journal entries. This trial balance represents the accounts with their corrected balances at the end of the accounting period. An unadjusted trial balance is prepared. The accounting cycle is the holistic process of recording and processing all financial transactions of a company from when the transaction occurs to its representation on the financial statements Three Financial Statements The three financial statements are the income statement the balance sheet and the statement of cash flows. Trial Balance in the Accounting Cycle.

Unadjusted trial balanceadjusted trial balance and post-closing trial balance. In what order should they be prepared. The accounting cycle requires three trial balances be done. The trial balance is a list of all the accounts a company uses with the balances in debit and credit columns. Here note that accountants create a trial balance after posting all the periods transactions to the general ledger but before they transfer account balances to the periods financial reports. After posting all financial transactions to the accounting journals and summarizing them in the general ledger a trial balance is prepared to verify that the debits equal the credits on the chart of accountsThe trial balance is the next step in the accounting cycleIt is the first step in the end of the accounting period process. They are then posted to the ledgers for the preparation of the trial balance. Trial Balance is prepared basically to check if debit or credit amounts recorded in the ledger accounts are accurate. Business Liquidity and the Operating Cycle 221 Working Capital. What Does Accounting Cycle.

It is usually used internally and is not distributed to people outside the company. This is an essential phase before proceeding further to prepare the final. Unadjusted post-closing adjusted Unadjusted adjusted post-closing Post-closing unadjusted adjusted Post-closing adjusted unadjusted Which of the following is considered to be an accrued expense. O unadjusted adjusted post-closing 48. This trial balance represents the accounts with their corrected balances at the end of the accounting period. When ledger postings are completed and accounts are balanced the next phase in the accounting cycle is preparation of a Trial Balance. Business Liquidity and the Operating Cycle 221 Working Capital. The accounting cycle requires three trial balances be done. Adjusting entries are journalized and posted to the ledger. Trial Balance in the Accounting Cycle.

Exhibit 1 summarizes the sequence of steps in the Accounting Cycle. O unadjusted adjusted post-closing 48. Verify that the debits and credits are in balance. Financial statements are prepared. It is usually used internally and is not distributed to people outside the company. The Accounting Cycle and Closing Process 191 The Closing Process 192 Post Closing Trial Balance 193 Revisiting Computerization 20. An optional end-of-period spreadsheet is prepared. Unadjusted post-closing adjusted Unadjusted adjusted post-closing Post-closing unadjusted adjusted Post-closing adjusted unadjusted Which of the following is considered to be an accrued expense. Another name for the balance sheet 62 3 points A business borrows cash from a bank. All of the income and expense accounts are typically closed to a general income summary account which is later closed to the retained earnings or capital account.