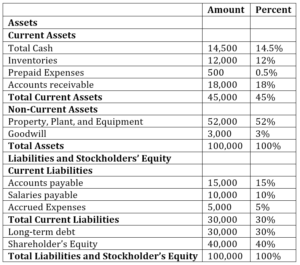

Common-size Income Statement is the vertical analysis of Income Statement in which value of Revenue from Operations is taken as 100 and values of other items of Statement of Profit and Loss are expressed as percentage of Revenue from Operations. Income statement items are stated as a percent of net sales and balance sheet items are stated as a percent of total assets or total liabilities and shareholders equity. Viz comparative statements common size statements and trend analysis. Examples of Common Size Balance Sheet Analysis. On the other hand the decline in net income. Click below to download a free sample template of each of these important financial statements. These topics will show you the connection between financial statements and offer a sample balance sheet and income statement for small business. Your income statement and balance sheet are two of the most important documents you will create as a business owner. Furthermore such a statement helps in a detailed analysis of the changes in line-wise items of the income statement. Typically investors will look at a companys common size balance sheet and common size income statement.

Each of the following methods gives visibility into trends that your business. Common Size Income Statement is calculated as. Examples of Common Size Balance Sheet Analysis. What is Common Size Analysis. Prepare balance sheet for F. For balance sheets all assets are expressed as a percentage of total assets while Financial statement analysis applies analytical tools and techniques to fi nancial statements to determine the operating and fi nancial. Common size simply is when you take each line on the income statement and divide it by the revenue in the same period. In the absence of information about the date of repayment of a liability then it may be assumed. The balance sheet and the income statement are two of the three major financial statements that small businesses prepare to report on their financial performance along with the cash flow statement. A common size income statement is an income statement in which each line item is expressed as a percentage of the value of sales to make analysis easier.

Green as at 31 March 2015 in both horizontal and vertical style. Let us take the example of Apple Inc. Income statement items are stated as a percent of net sales and balance sheet items are stated as a percent of total assets or total liabilities and shareholders equity. Analysis of Financial Statements 181. Common-size Income Statement is the vertical analysis of Income Statement in which value of Revenue from Operations is taken as 100 and values of other items of Statement of Profit and Loss are expressed as percentage of Revenue from Operations. Youll need the three main financial statements for referencethe balance sheet income statement and statement of cash flows. These three core statements are. Common Size Analysis of Financial Statements involves looking at the numbers on the financial statement as a percentage of a total rather than their absolute value. Green as at 31 March 2015. Income Statement and Balance Sheet of companies.

The following trial balance is prepared after preparation of income statement for F. Income Statement and Balance Sheet of companies. Income statement items are stated as a percent of net sales and balance sheet items are stated as a percent of total assets or total liabilities and shareholders equity. Common Size Statements Common size statements examine the proportion of a single line item to the total statement. Your income statement and balance sheet are two of the most important documents you will create as a business owner. Green as at 31 March 2015 in both horizontal and vertical style. Common-size analysis allows for the evaluation of. The balance sheet and the income statement are two of the three major financial statements that small businesses prepare to report on their financial performance along with the cash flow statement. These three core statements are. Financial Statement Analysistechniques involving simple math which can help you perform a financial statement analysis for your business.

An income statement is just one of the many documents included in a financial statement which also includes other financial reports like the balance sheet and cash flow statementAlso called the profit and loss statement the income statement focuses on the revenue and losses of the company basically providing the company an overall view of their gains and. Green as at 31 March 2015. Common-size Income Statement is the vertical analysis of Income Statement in which value of Revenue from Operations is taken as 100 and values of other items of Statement of Profit and Loss are expressed as percentage of Revenue from Operations. These three core statements are. Common size simply is when you take each line on the income statement and divide it by the revenue in the same period. Common size analysis also referred as vertical analysis is a tool that financial managers use to analyze financial statements Three Financial Statements The three financial statements are the income statement the balance sheet and the statement of cash flows. Common-size analysis allows for the evaluation of. Let us take the example of Apple Inc. Video No- 39This video will help you to understand the concept and assist you while solving the practical problems related to COMMON SIZE STATEMENT ANALYSIS. Prepare balance sheet for F.